OpenAI, founded in 2015 by prominent tech leaders including Sam Altman and Elon Musk, emerged with a bold mission to ensure that artificial general intelligence (AGI) benefits all of humanity. Initially backed by a collective pledge of $1 billion, the organization has rapidly become a pivotal player in the AI industry.

OpenAI has positioned itself at the forefront of artificial intelligence development through groundbreaking research and innovative products. As the company continues to evolve, its financial landscape has garnered significant attention.

This article delves into OpenAI's financial aspects, including its current valuation, substantial investments, impressive revenue growth, and the essential products driving its success. By examining these elements, we can better understand OpenAI's impact on the AI industry and its future potential.

OpenAI Valuation

OpenAI's valuation is a key indicator of its market position and financial health. As of early 2024, OpenAI's valuation ranges between $27 billion and $29 billion. This significant valuation reflects the company's rapid growth, driven by its innovative AI technologies and substantial investments from major partners like Microsoft. Due to continuous progress and the introduction of new products, OpenAI's value is on track to surpass $100 billion.

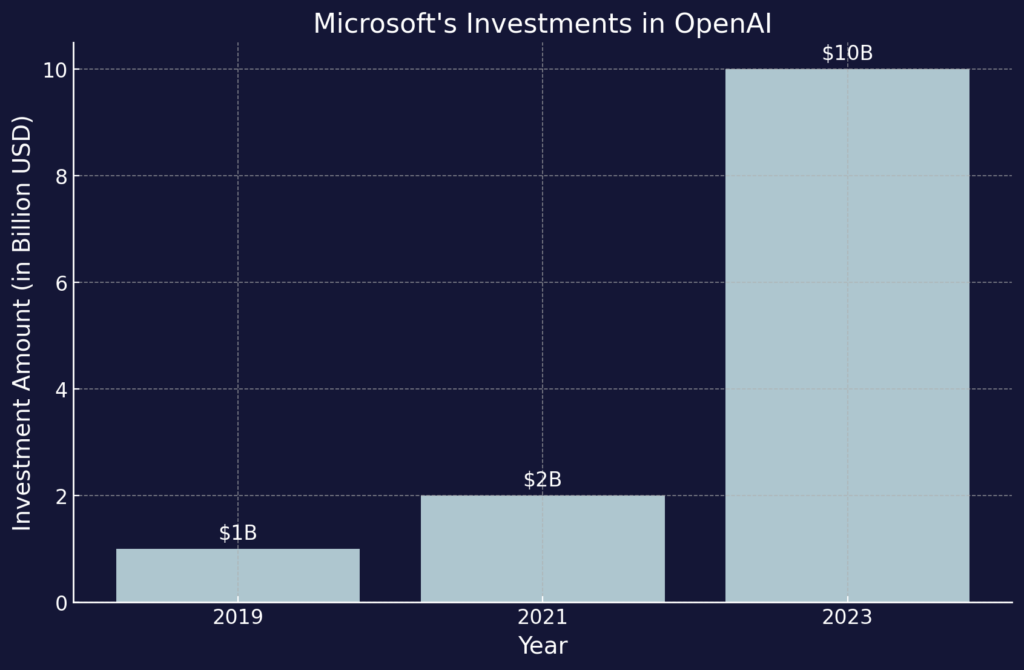

Microsoft’s $13 Billion Investment

Microsoft's substantial investments in OpenAI have played a crucial role in the company's growth. Microsoft has invested $13 billion in OpenAI, including a $10 billion investment in early 2024. This strategic partnership has significantly boosted OpenAI’s valuation and enabled the integration of its technologies into Microsoft’s products, enhancing its market presence.

Revenue Growth

OpenAI's revenue growth has been remarkable, reflecting the increasing demand for its products and services. OpenAI generated approximately $200 million in revenue in 2024, a dramatic increase from $10 million in 2022. This exponential revenue growth indicates the rising demand for OpenAI’s products and services across various industries.

OpenAI anticipates generating $1 billion in revenue by 2024, highlighting the company’s expanding influence in the AI market. Some estimates suggest that OpenAI's annualized recurring revenue could reach $5 billion by the end of 2024, reflecting the company's strong market position and the increasing integration of its AI solutions across diverse sectors.

Major Investments

Significant investments, particularly from Microsoft, have fueled OpenAI's growth. These investments have provided the financial resources to develop advanced AI technologies and expand market presence:

Microsoft's Initial $1 Billion Investment in 2019

Microsoft made its first significant investment in OpenAI in 2019, committing $1 billion. This investment laid the foundation for a strategic partnership, allowing OpenAI to leverage Microsoft’s Azure cloud platform for its AI research and development.

Additional $2 Billion Investment in 2021

In 2021, Microsoft expanded its support for OpenAI with an additional $2 billion investment. According to Investing in the Web, this second round of funding helped accelerate the development of advanced AI models and further integrated OpenAI’s technologies into Microsoft’s suite of products.

Significant $10 Billion Investment in Early 2024

Early in 2024, Microsoft invested $10 billion in OpenAI, solidifying its commitment to AI innovation. This significant funding round was pivotal in scaling OpenAI's operations and enhancing its market position. It also facilitated the integration of AI capabilities into Microsoft Office and other products.

Microsoft holds a 49% profit stake in OpenAI following these investments, which is practical after recouping its initial investments. This arrangement highlights the two companies' deep financial and strategic ties, ensuring mutual benefits from OpenAI’s future successes.

Revenue Growth Trajectory

OpenAI's revenue trajectory showcases its rapid expansion and market penetration. OpenAI's revenue growth has been remarkable:

- $10 million in revenue for 2022

- $200 million in revenue for 2024

- Projected $1 billion in revenue for 2024

- Annualized recurring revenue will reach $5 billion by the end of 2024

This optimistic outlook reflects the company’s robust sales momentum and the potential launch of new AI services to sustain and enhance its revenue streams.

Products and Popularity

OpenAI's products have played a crucial role in its popularity and market value. From ChatGPT to DALL-E and Whisper, these AI technologies have driven user engagement and revenue growth.

ChatGPT: Fastest-Growing Platform with 100 Million Users in Two Months

Launched in November 2022, ChatGPT quickly became the fastest-growing platform in history, reaching 100 million users within two months. This unprecedented growth has significantly boosted OpenAI’s valuation and established ChatGPT as a leading AI product in the market.

DALL-E and Whisper: Other Notable AI Products

In addition to ChatGPT, OpenAI’s other notable products include DALL-E, an AI system that generates images from text prompts, and Whisper, a neural network for language transcription and translation. These innovative products have contributed to OpenAI’s reputation and market value.

Popularity Metrics

OpenAI’s website, openai.com, recorded approximately 1.7 billion monthly visits in mid-2024, highlighting its immense popularity and widespread interest in AI technologies. In June 2024, openai.com was ranked as the 20th most visited website globally, reflecting its significant online presence and the high level of user engagement with OpenAI’s offerings.

Operational Costs

Running a cutting-edge AI company comes with substantial operational expenses. OpenAI’s operational expenses are significant, with monthly computational costs estimated at $3 million. This high expenditure is necessary to support the extensive computational power required for training and running large AI models like GPT-4. Engineers at OpenAI receive compensation packages averaging $925,000 annually, with a significant portion, approximately $625,000, coming from stock options.

Future Outlook

Looking ahead, OpenAI is focused on developing new AI models and deepening its integration with Microsoft products. OpenAI is actively developing GPT-5, aiming to incorporate significant enhancements such as a potential parameter increase of up to 6-7.5 trillion and new multimodal capabilities like video processing.

OpenAI’s AI technologies continue to integrate with Microsoft products, enhancing functionality in MS Office and Azure services. This partnership, supported by Microsoft’s $13 billion investment, significantly boosts OpenAI’s market presence.

Summary of OpenAI's Financial and Operational Status

OpenAI, valued at $27-29 billion in early 2024, has seen rapid revenue growth from $10 million in 2022 to a projected $1 billion in 2024. High operational costs include $3 million monthly in computational expenses and $925,000 average annual engineer compensation.

Impact of Major Investments on Valuation

Microsoft’s cumulative $13 billion investment has significantly bolstered OpenAI’s valuation and facilitated deep integration of its AI technologies into Microsoft products like MS Office and Azure. This partnership has been pivotal for OpenAI's market expansion.

Reflection on OpenAI's Role in the AI Industry and Broader Implications

OpenAI's advancements in AI technology have profound implications for various industries and society. Its commitment to developing ethical and accessible AI ensures that AGI benefits all of humanity. This ongoing innovation positions OpenAI as a leader in shaping the future of AI.